As an insurance agent, you spend months or years training to help keep your customers protected from errors, accidents, natural disasters, and illnesses. You probably didn't dream of spending days creating proposals to sell your services, but that is part of the job.

The right proposal software can make your life easier, giving you back valuable time to focus on taking care of your clients, their property, and their businesses.

To help you find the perfect proposal software to help you win more deals more efficiently, we rounded up some of our favorites and compared them on features, functionality, and pricing.

Key Takeaways

- Software can help insurance companies sell more deals to potential clients

- There are many types of proposal software that can help with everything from commercial insurance proposals to health insurance proposals

- Combining electronic signature software features with proposal software makes a more powerful tool

- The right software for your business depends on your sales team structure, budget, and the type of insurance you sell

Insurance proposal tools at a glance

| Insurance proposal software | Standout Feature | Integrations | Starting Price* (USD) | Best For |

|---|---|---|---|---|

Qwilr | The ability to add plain text agreements helps sellers turn proposals into done deals | Integrates with popular CRMs, payment processors, and other commonly used sales technology for seamless automation | $35 per user/month | Insurance companies with sales teams |

PandaDoc | HIPAA Compliance | Integrates with many CRM, payment processors, and other collaboration tools like Slack | $19 per user/month | Insurance companies in the healthcare space |

DocuSign | Mobile-friendly signing for customers on the go and IAM (Intelligent Agreement Management) to help agents maximize productivity | 900+ integrations, including Salesforce and Zoom | $35 per user/month | Individual insurance agents |

Proposify | Create proposals quickly and efficiently | Offers basic native integrations as well as a variety of integrations through Zapier | $29 per user/month | Insurance companies with more templated packages or smaller teams |

Freshbooks | As both accounting and proposal software it allows users to turn proposals into invoices for easy payments | Many integrations are available through their app store, including CRMs, payment processors, and appointment scheduling | $19 per user/month | Finance management & proposals all-in-one |

Better Proposals | Template library, eSignature, and payment capabilities cover the basics nicely | Integrates with CRMs, payment processors, live chat, and Zapier | $21 per user/month | Best for individual agents or new teams |

How to choose proposal software: Features insurance sales teams should look for

- Templates: Create and customize professional proposal templates with placeholders for personalization with client-specific information.

- A Comprehensive Content Library: Store and manage essential content, such as policy descriptions, coverages, and limitations, for easy access and version control. If the team sells many types of policies with different coverages, the volume of information can grow quickly. You want proposal software that can help with organization.

- Pricing and Quoting: Look for software with the ability to create custom quotes and share pricing based on specific variables. For example, letting prospects see how reducing their premiums might increase their deductibles.

- Automation: Find software that helps you run your insurance agency more efficiently with common automation and integration with other tools you use to manage relationships or produce quotes for potential clients.

- E-Signature: Software with e-Signature functionality makes it easier for prospective clients to turn insurance quotes into formal agreements in one application. This removes friction from the sales process and can help you close deals faster.

- Document Management: Store and organize proposals, contracts, and other documents in a centralized location. No more hunting for old documents or looking for last year's policy info.

- Contract Creation: Make it easier to make coverage official by embedding contracts in the same software you use to send insurance quotes and proposals.

Top 6 proposal software for insurance companies in 2024

No matter what kind of insurance you and your team sell, there is a proposal software that will meet your needs. These six tools are some of our favorites when it comes to creating sales proposals for your insurance business.

1. Qwilr: Best for insurance firms with sales teams

If you have a sales team, Qwilr is the tool that stands out. We certainly have to brag about the features we have to help teams collaborate and understand how their proposals are performing with customers. This valuable data can help the entire team improve their proposals and sales process.

Standout features

Some of the features we love most for our insurance industry customers are:

- Interactive web-based proposals: Create engaging, mobile-responsive proposals that include interactive elements like video, images, and payment options, making the experience seamless for clients

- Ability to embed interactive elements and spreadsheets: With Qwilr, insurance agencies, and sales reps have the ability to embed spreadsheets and interactive elements in a visually compelling proposal. This means it's easy to share data in the form of tables, video explainers, and even calculators to show costs based on different types of coverage.

- Shareable templates: We also want to brag about the ability to share templates across the entire team. The entire sales team can have access to a robust template library to send consistent, on-brand proposals. Using the same proposal structure can help sales teams understand how proposals are performing and spot opportunities for continuous improvement.

- Agreements: Another feature we talk about and love to see insurance organizations take advantage of is the agreements feature to get deals done efficiently. Having the ability to share plain text agreements via the same software as your proposals keeps both customers and legal teams happy.

- Real-time alerts: Getting real-time notifications about when customers are looking (and what they're looking at) can help sales team members strike while the iron is hot.

- Analytics: Learn more about how prospects interact with proposals. Qwilr’s built-in analytics show who is opening documents, what they’re looking at, and how long they’re staying. This can help craft the right follow-up at the right time, too.

- eSignature & Payment: Make the end of the sales process easy. Leverage eSignature capabilities and integration with payment processors so that prospects can sign and make that first payment quickly and efficiently—all within your web-based proposal.

Try before you buy. We always offer new customers a 14-day free trial.

- Business plan: $35 USD / user per month when billed annually. This includes our unlimited pages, eSignature features and payments, content editor, ROI calculator, analytics, and more

- Enterprise plan: $59 USD / user per month. Everything in the Business plan plus a dedicated accountant manager, a custom domain, and extended features.

| ✅ Pros | ❌ Cons |

|---|---|

Easy to use - Sales teams can be up and running quickly and efficiently | Proposals can’t be formatted as presentations |

Plenty of templates - Grab one from the template library to customize or build your own | You can’t upload your own documents to use, however, you can embed them into the page itself |

Built-in agreements functionality - Add a plain text contract for prospects to sign on the (electronic) dotted line |

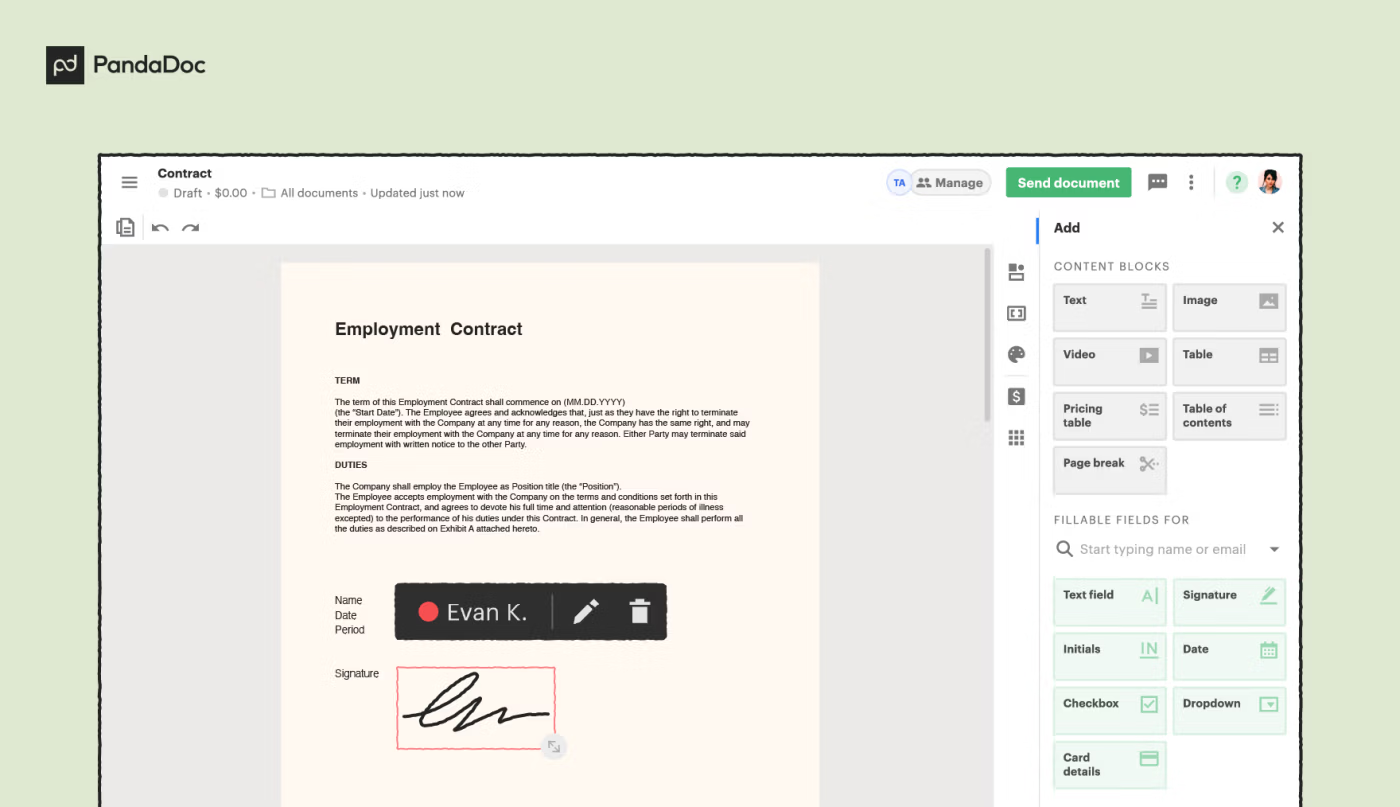

2. PandaDoc: Best for insurance firms in the healthcare industry

For sellers in the healthcare industry, PandaDoc stands out from the crowded field of insurance proposal software tools by having a HIPAA-compliant eSignature solution. It also has many of the bells and whistles you come to demand from a proposal generation tool. It falls short with interactive elements and the ability to completely automate workflows.

Standout features

- HIPAA-Compliant eSignature: We love that PandaDoc's signature software is not only HIPAA compliant but also E-SIGN and UETA compliant. Another thing to note is the SOC 2 certification backing, so your customers can sign with total confidence.

- Payment Processing: To get your deals done efficiently, you want to remove as much friction as possible from the sales process. This is why integrating with popular payment processors makes PandaDoc an appealing choice. Prospects can sign their agreements and pay that first premium or any fees quickly and efficiently, giving insurance salespeople more time to focus on serving customers instead of chasing down signatures and payments.

- Analytics & Audit Trail: Stop following up to see if prospects have gotten your proposals or agreements and spend more time helping your customers. PandaDoc's built-in analytics and audit trail can tell you if your proposals have been received, opened, read, and signed. No emails or phone calls necessary!

Pricing

- Starter Plan: $19 USD per user / month

- Business Plan: $49 USD per user / month

- Enterprise Plan: Contact sales

| ✅ Pros | ❌ Cons |

|---|---|

HIPAA, GDPR, U.S. Esign Act of 2000, SOC 2 Type II compliance | It's not as good as a proposal tool. There aren't as many robust proposal features, better suited for sending contracts and agreements |

Has built-in recipient Analytics & Audit Trail | Onboarding and setup can take more time than other proposal tools |

Integrations with popular CRM, Payment Processing, and Collaboration tools | There is no functionality for dynamic pricing tables or an ROI calculator |

3. Docusign: Best for individual insurance agents with long contracts

While Docusign isn't specifically designed for proposals, it can be an asset to those in the insurance industry, especially those flying solo. It’s a great tool for individuals who want to streamline their policy signing process—providing audit trails and ensuring compliance with industry regulations

Standout features

- Intelligent Agreement Management (IAM): Docusign offers what they call Intelligent Agreement Management (IAM). This functionality helps sellers capture more insights from their agreements and manage the complete lifecycle. While this sounds like buzzword bingo to us, they claim it can save time and reduce inefficiencies.

- eSignature capabilities: Prospects can sign agreements from anywhere and even on their phones to make it easy to get deals done.

- Electronic notarization: If documents must be Notarized, Docusign makes it so that this can be done electronically

- Multi-channel delivery: Agreements can be sent via SMS or WhatsApp, so you won't need to rely on email anymore.

Pricing

The pricing for Docusign is dependent on whether you want to leverage IAM functionality or basic eSignature.

- eSignature: Plans start at $10/month for individuals or $25/user per month for businesses through the standard package. For teams needing more automation capabilities, the Signature Business Pro plan starts at $40/user per month.

- IAM: The Intelligent Agreement Management plans start at $35/user per month ($420 when billed annually) for the standard plan. They also offer a professional plan (for For teams managing end-to-end agreement workflows with forms, automation, and AI) that starts at $65/user per month or $780 when billed annually. For enterprise accounts, as with most software, you will need to contact sales to learn more about pricing options.

| ✅ Pros | ❌ Cons |

|---|---|

IAM functionality is available to help gain more insights from agreements and drive more value for insurance businesses. | It is not designed for interactive proposals. The focus is primarily on agreements. |

Customers can sign documents from anywhere in the world (and via mobile). | Many of the advanced features and integrations are only available on the pricier plans. The plans designed for individual agents are more limited in functionality. |

You can upload any document you need signed and share it with your customer. | For best performance, Docusign recommends restricting your file uploads to no more than 5 MB. This can be challenging with longer agreements. |

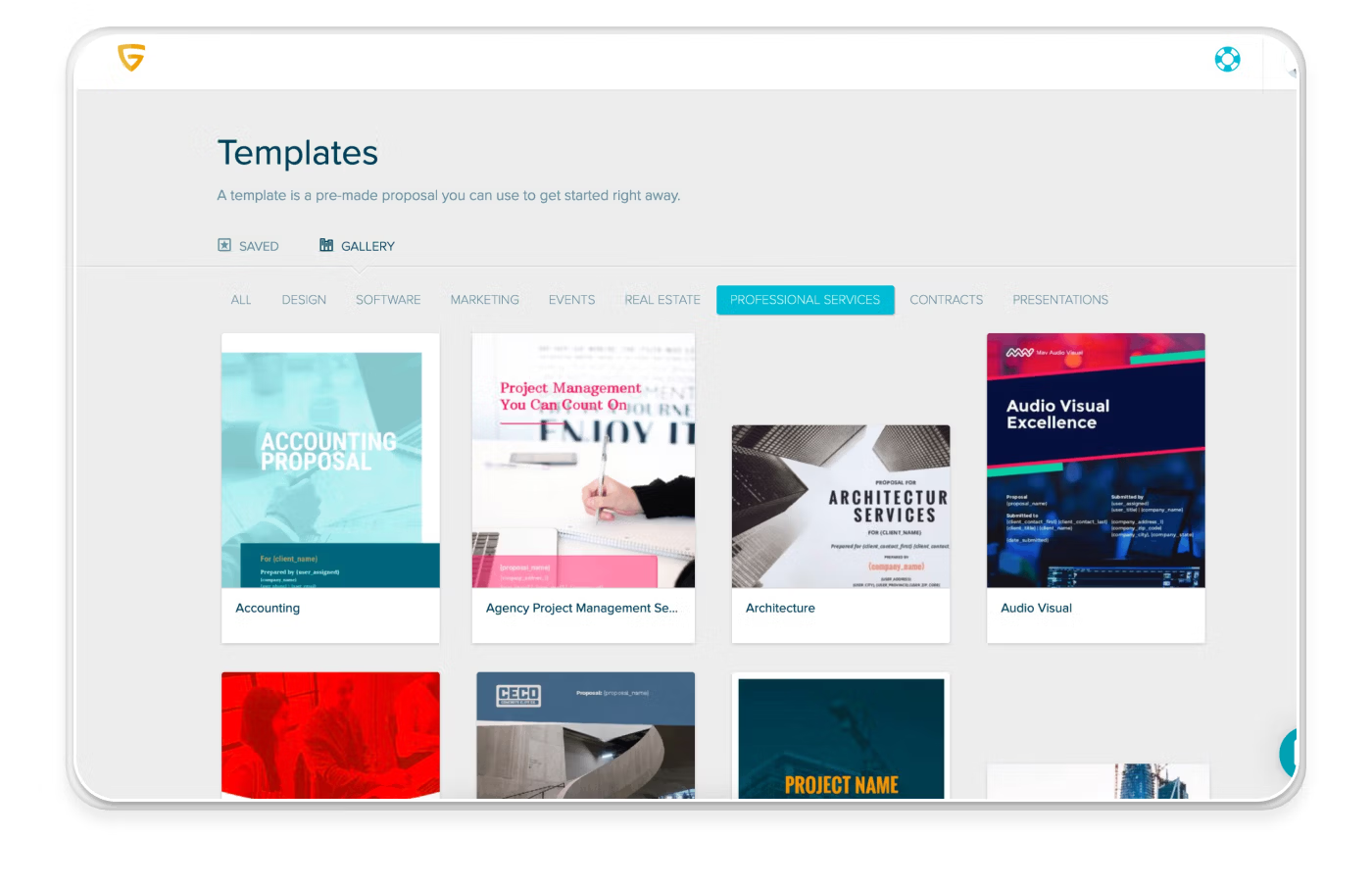

4. Proposify: Best for Insurance agencies with smaller teams

Proposify aims to give insurance sales agents visibility and control in the sales process. Agents can create visually appealing on-brand documents that can be viewed and signed electronically. Or, for the old-school customers—downloaded as PDFs.

Standout features

- Template creation: Speed up the proposal writing process by creating templates for commonly sold packages or boilerplate information (like the about the agency section).

- Embedded images and videos: Having the ability to add images and videos can help make complex insurance information easier to understand. This might include a chart comparing the proposed plan or a video walkthrough that answers the most frequently asked questions.

- Ability to download documents as PDFs: For customers who want to print out or electronically file the proposal, it's easy to download Proposify documents and save them as PDFs.

Pricing

Proposify offers three pricing tiers for users depending on their needs

- Basic: This entry-level package is designed for those who are just getting started. The cost is $35/user per month when billed monthly or $29/user per month when paying for the full year upfront. With this plan, you are limited to only two users and five document opens a month.

- Team: The team pricing level is better suited for sales teams. The billing options here are either quarterly or annual - teams can't pay monthly. The cost for this level is $49/user per month when billed quarterly or $41/user per month when billed annually. This pricing level includes 30 document opens per month and standard integrations, branded domains, and custom fields and variables.

- Business: The highest Proposify plan, the Business Plan, is geared towards teams of 10+ people or teams that are beginning to scale. It costs $65/user a month and requires annual billing. The plan includes everything from the team pricing tier and adds the Salesforce integration, Single Sign On (SSO), approval workflows, and permissions.

| ✅ Pros | ❌ Cons |

|---|---|

Visibility into the entire proposal process | Making edits can be challenging |

Ability to embed media elements like images and videos | Templates have limited customizations |

Easy to set up and use | Most integrations require Zapier |

5. Freshbooks: Best for finance management & proposals all-in-one

Freshbooks is best known as accounting software, but it has much more comprehensive functionality, including being able to be used to create and send proposals. This is a better choice for individuals and small teams, but we'd be remiss not to include this option as it can be helpful to new businesses with limited budgets.

Standout features

- Custom proposals with images and attachments: Freshbooks gives insurance agents the ability to share high-level information with prospects in an easy-to-read, visually appealing way. They can also attach documents that contain the fine print so that prospects can learn more if their interest is piqued.

- In-app Commenting: Use comments to better collaborate and get the deal done.

- Approval and eSignature: Take advantage of this popular functionality that helps close deals more efficiently and shortens sales cycles.

- Ability to convert proposals to invoices: Have prospects accept the proposal and pay their first invoice right in one tool

Pricing

- Lite: This plan starts at $19 a month with a 10% discount for paying for the full year. It includes unlimited invoices for up to 5 clients, the ability to send unlimited estimates, and payments through ACH and credit cards. This plan won't work for most insurance salespeople as it is limited to the five clients for invoicing and this level only includes estimates. Additional team members can be added for $11 per month.

- Plus: This plan starts at $33 per month, and like the Lite plan, additional users can be added at $11 per month. The plan includes everything from the lite but expands the customers for unlimited invoicing up to 50 and allows users to send unlimited proposals.

- Premium: The premium plan starts at $60 per month and includes everything in the plus plan. It eliminates the client cap on invoicing, allowing you to send unlimited invoices to unlimited clients. It also helps teams track profitability.

- Let's Talk: This option is for enterprise needs, and the pricing can only be shared by contacting the Freshbooks sales team. The pricing page does tease some additional functionality here, including an easy switch for data migration, unlimited estimates, and proposals, lower fees for credit cards and ACH, the ability to set up retainers and monthly payments, and more.

| ✅ Pros | ❌ Cons |

|---|---|

Easy to set up and use | Limited number of clients for lower-tier plans |

Includes invoicing in the same software | Users complain about invoice issues and getting money quickly |

Good customer support | Lacks some of the more powerful features found in other proposal tools |

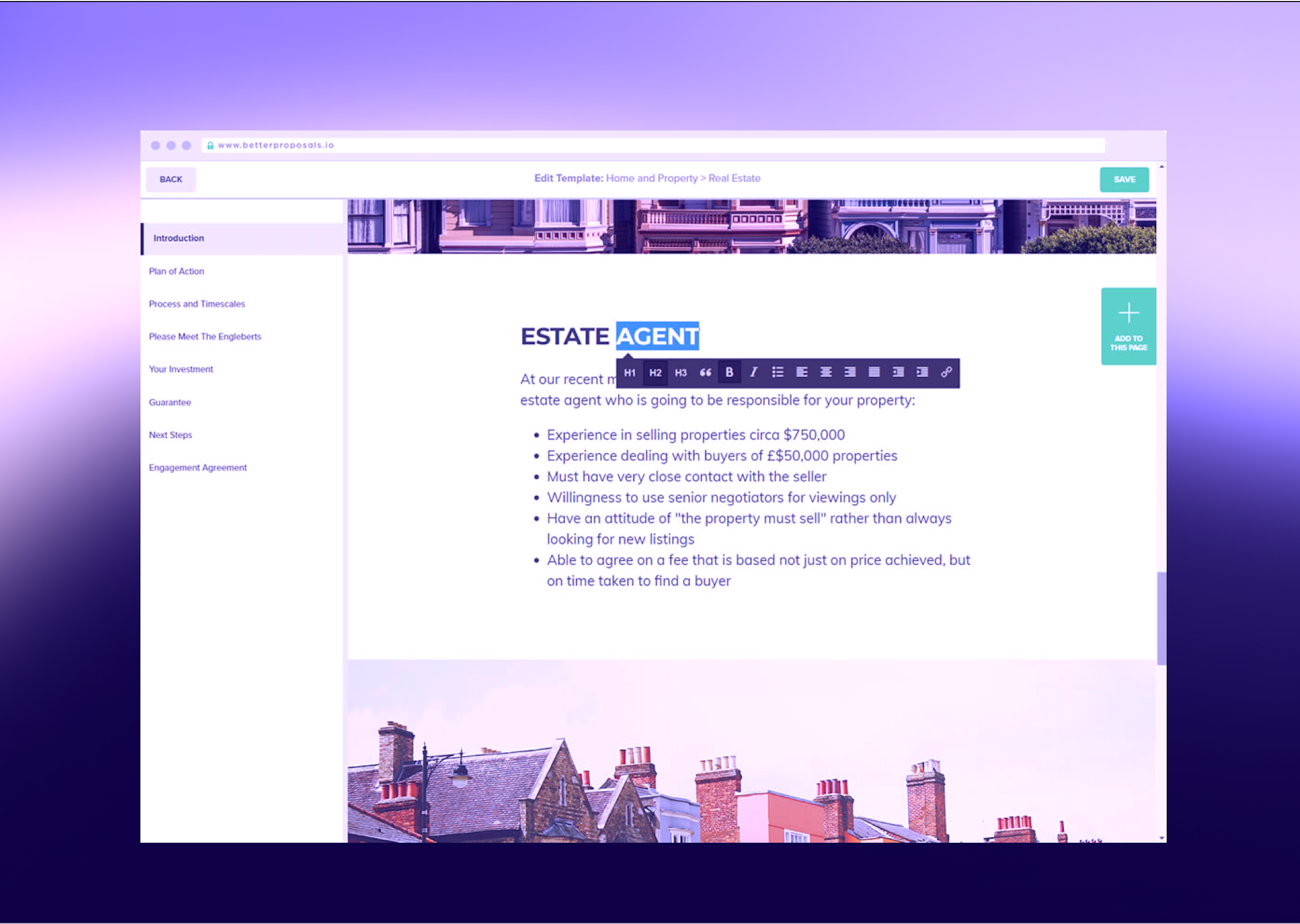

6. Better Proposals: Best for individual agents or new teams

Better Proposals is another option that could work well for a variety of insurance teams selling different insurance types. For solopreneurs or those just starting out in the industry, some of the more basic plans may fit the bill nicely until it's time to scale. Then, it may be challenging to keep to the proposal monthly limits or operate without some of the integrations that can help business processes flow together seamlessly.

Standout features

- Content Library: Access to customizable templates and resources to create professional-looking insurance proposals and quotes.

- CRM Integrations: Integrates with a number of popular CRMs to streamline the sales process and capture as many details as possible about potential clients.

- Payments: Native integrations make it easy to turn prospects into customers by allowing payment to take place within the proposal software.

- E-signatures: Clients can easily sign their documents from anywhere. No more waiting for a fax, email, or FedEx envelope.

- Analytics and Reporting: Track proposal performance and forecast for the next month, quarter, or year with detailed analytics.

- Document Security Features: Provides security measures to protect sensitive information. Password protection is available with the highest level plan.

Pricing

Better Proposals offers three plans with increasing pricing (and features) at each level.

- The Starter Plan: This plan runs $19 per user per month when paid monthly or $13 per user per month when paying annually. It limits users to 50 proposals or fewer per month.

- The Premium plan: This plan will cost insurance sales teams $29 per user per month when paid monthly and $21 per user per month when paid annually. It also limits users to 50 proposals or fewer per month. But, in addition to all of the functionality included in the starter plan, it adds custom domains, the Zapier integration, and some AI features for additional customization.

- The Enterprise Plan: This is Better Proposal's most comprehensive plan and is great for larger insurance companies with more robust sales teams (and maybe even some sales enablement roles). It costs companies $49 per user per month when paid monthly and $42 per user per month when paid annually. It does not have a limit on the number of proposals or documents that can be sent each month. And, in addition to the features offered at the other tiers, it adds individualized training and support, password protection for proposals, and approval workflows.

| ✅ Pros | ❌ Cons |

|---|---|

It can be a good entry-level proposal tool due to the lower-priced tier | The price can be deceptive, as the lower-priced options lack some functionality that can be important for teams. |

Won't overwhelm smaller teams with too many bells and whistles | Lower tiers are limited to 50 proposals per month, which could be a challenge for a growing team. |

Has advanced features available for larger teams that need them | Only one pricing block can go in each proposal. Limiting the ability to share multiple options or outline different scenarios based on the plan premiums, deductibles and payouts. |

Upgrade to modern, digital proposals with Qwilr

By investing in the right proposal software, insurance sales teams can significantly enhance their efficiency, improve proposal quality, and ultimately boost sales. The ability to create tailored, professional proposals quickly and accurately is essential in today's competitive and crowded market.

As you evaluate these tools and think about the features that will help drive your business forward, we invite you to demo Qwilr or try it yourself for 14 days, on us.

About the author

Dan Lever|Brand Consultant and Copywriter

Dan Lever is an experienced brand consultant and copywriter. He brings over 7 years experience in marketing and sales development, across a range of industries including B2B SaaS, third sector and higher education.